The makeup of the workforce has changed recently with a growing number of healthcare professionals embracing the flexibility and independence that comes with being a 1099 worker. To address the changing nature of employment, the Department of Labor has introduced new guidelines that focus on the classification, rights, and protections of independent contractors. In this blog post, we will discuss the implications of these changes and how they might shape the future for 1099 healthcare professionals. You can read the DOL’s news release here. The rule was officially published on January 9, and will be effective on March 11, 2024.

Understanding the Change:

Since the beginning of COVID-19, many healthcare employers have found it difficult to find rising talent and have looked to 1099 workers to meet their needs. Sometimes, these workers were misclassified as 1099 versus employees. The rise of the gig economy and the surge in both freelance and independent contract work have prompted the Department of Labor to reassess its approach to worker classification. The new guidelines seek to provide a clearer definition and improved guidelines for both employers and workers. The new rule will rescind the 2021 independent contractor rule. Most likely, the new guidelines will make it more difficult for businesses to classify workers as an independent contractor.

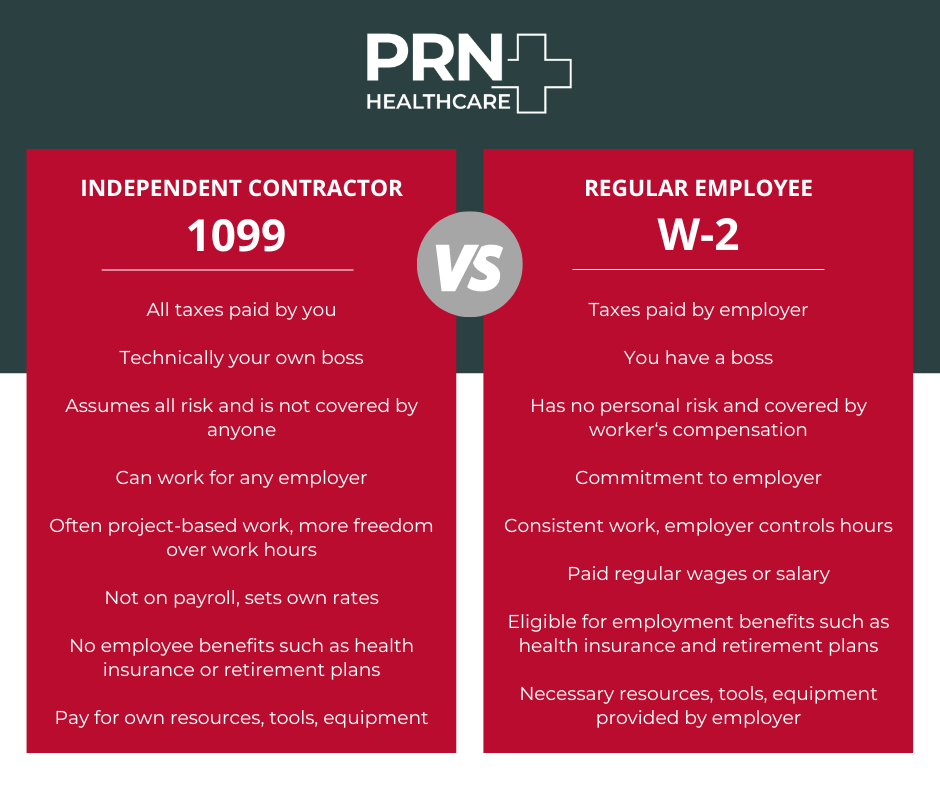

What is the difference between a 1099 worker and a W-2 employee?

A 1099 worker is a freelancer, independent contractor, or other self-employed worker that completes a particular job or assignment but is not an employee of the company. They are not paid wages or a salary, and may not be eligible for healthcare benefits, paid time-off or retirement plans.

A W-2 employee is a person who received a regular wage or salary for performing their job and is eligible for other benefits. According to the IRS website, the general rule was that one is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

1099 workers often work under a specific contract or an agreement that outlines the scope of work, payment terms, and other relevant details. The term “1099 worker” is derived from the IRS tax form 1099-MISC, which is used to report the income earned by independent contractors.

Key Highlights of the New DOL Guidelines:

- Clarification of Independent Contractor Status: The Department of Labor’s updated guidelines seek to provide a more precise definition of what constitutes an independent contractor. A clearer distinction between employees and independent contractors can help businesses make more informed decisions on the classification of their workers.

- Protections for 1099 Workers: The new guidelines emphasize the need for protections and benefits for independent contractors. While they are not entitled to the same benefits as a traditional employee, the guidelines encourage fair compensation, certain workplace protections and opportunities for dispute resolution.

- Flexible Work Arrangements: The Department of Labor attempts to accommodate the unique nature of 1099 work including a flexible schedule and variance in work arrangements associated with independent contractor work including considerations for remote work, project-based work, and non-traditional working hours.

- Transparency in Contracts: The new guidelines stress the importance of clear and transparent contracts between employers and 1099 workers so that both parties understand the arrangement to help prevent disputes and promote a successful working relationship.

Potential Challenges and Opportunities:

While the new guidelines may provide more clarification in the recognition and protection of 1099 workers, there are many challenges. It may be difficult to find the right balance between flexibility for independent contractors and protections. Employers may need to reassess their work practices and adjust their policies to comply with the updated guidelines.

It’s important for both businesses and independent contractors to understand the distinctions between employees and independent contractors to ensure compliance with labor laws and tax regulations. Misclassifying workers can lead to legal and financial consequences for businesses.

Compliance with the new guidelines is essential to avoid legal issues, and ensure fair and transparent working relationships between healthcare professionals and the organizations that they work with. Consulting with both legal and tax professionals may be beneficial for additional guidance based on your specific circumstance and the industry norms. The guidelines will most likely vary by state with California, Illinois, New Jersey, and Massachusetts being among the states that apply more stringent application.

In addition, the new changes could provide new opportunities for more collaboration between businesses and independent contractors. As the regulatory environment becomes clearer, both parties can work together with confidence and foster a more productive and mutually beneficial relationship.

What does this mean for 1099 healthcare workers?

The Department of Labor’s rules on 1099 contractors can have implications for healthcare workers, just as they do for those in other industries. Here are some ways in which these rules may affect healthcare workers.

- Worker Classification: The Department of Labor’s aims to clarify the classification of workers as either employees or independent contractors. In healthcare, this could impact how certain roles are classified. For instance, some healthcare professionals may work as independent contractors for specific projects or periods, and the new guidelines may provide more clarity on the criteria for such classifications.

- Access to Benefits: 1099 contract healthcare workers generally do not receive traditional employee benefits such as health insurance, retirement plans, or paid time off. The new guidelines may influence discussions around providing certain benefits or protections for independent contractors within healthcare.

- Flexible Work Arrangements: Healthcare work often involves flexibility in schedules and project-based engagements (traveling positions). The Department of Labor’s emphasis on accommodating flexible work arrangements may align with the needs of healthcare workers who prefer non-traditional working hours or project-based contracts.

- Contractual Agreements: 1099 contract healthcare professionals often operate under specific contractual agreements. The new guidelines may impact both the content and structure of the agreements.

- Potential for Dispute Resolution: The guidelines seek to promote dispute resolution methods within the contacts themselves, providing healthcare workers and employers a framework for resolving conflict without legal action.

- Tax Implications: Healthcare workers operating as 1099 contractors are responsible for managing their own taxes. Any changes in tax regulations or reporting requirements from the DOL could affect how healthcare professionals handle their reporting.

How Do I Know If I Am a 1099 Contractor Under the New Regulation?

The DOL lays out 6 factors to consider when an employer is deciding a worker’s classification.

- The Opportunity for Profit Gain or Loss Utilizing the Skill

If the worker can negotiate the pay for the work, accept or decline jobs, market their skill, grow and/or expand their business, and has the opportunity to make decisions regarding hiring, purchasing, or renting space, they may be an independent contractor. - The Degree of Investment by Both Parties

If the worker makes “capital or entrepreneurial” investments in their business, they may be an independent contractor. Examples of these investments may include equipment, software, facilities, or marketing. - The Time Period of the Work

The worker may be an independent contractor if they are hired for a fixed time-period. - Nature and Degree of Control

The worker may be an independent contractor if they control their own schedule, are not supervised while completing the work, and are not restricted from working for others. - The Extent to which the Work is Important to the Employer’s Business

The worker may not be an independent contractor if the contracted work is an integral part of the business’ operations. - Skill and Initiative

The worker may be an independent contractor if the work requires a specialized skill set that the worker brings to the partnership.

Actions 1099 Healthcare Workers Should Take:

- Talk to an accountant about how your taxes may be affected with re-classification.

- Discuss the classification with any current company that utilizes you as a 1099 contractor and if any change will occur based on the new guidelines.

The Department of Labor’s new guidelines on 1099 workers signals a shift towards the acknowledgment of the unique needs of employers and the contributions of independent contractors in today’s workforce. By providing clearer definitions and encouraging fair treatment, these guidelines aim to create an improved environment for 1099 workers.

Legal Disclaimer: This information is general and not intended as professional legal advice. Any references to the law may not be current as laws regularly change at the federal and state level. If you have any questions, we recommend consulting with an attorney or tax professional.